Contents:

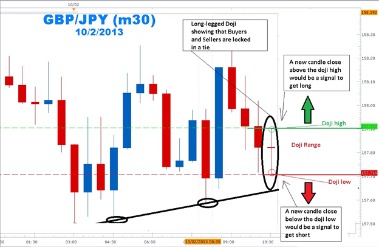

Candlestick charts are the most popular charts among forex traders because they are more visual. Candlestick charts highlight the open and the close of different time periods more distinctly than other charts, like the bar chart or line chart. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies.

- In other words, you should have a good risk/reward ratio.

- If you do want to trade counter-trend, then trading it with an early entry signal does provide the best prospects for both a reversal and a retracement.

- Less Trades in General – A lot of the time, markets simply don’t retrace enough to trigger the more conservative entry that comes with a pull back.

- The effect of this was to create a foreign currency transaction gain on the import purchase, and a foreign currency transaction loss for the export sale.

- Learning to recognize the hanging man candle and other candle formations is a good way to learn some of the entry and exit signals that are prominent when using candlestick charts.

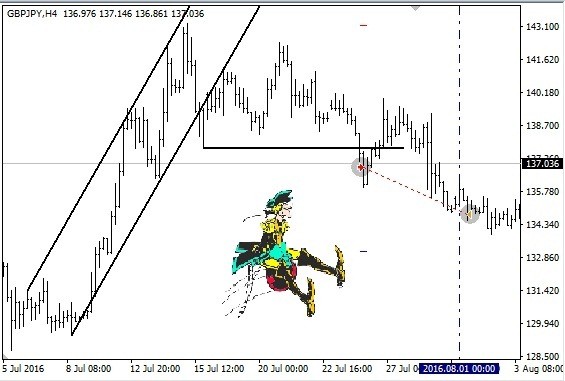

Take profit would initially be the size of the Asian session range. This means you want pairs that are going to be the most active during the London session, such as European currencies and their volatile currency cross variants. Take profit would be the size of the master candle back in the other direction.

Don’t miss out on great trading opportunities

On the other hand, some forex trading charts are very specific. It officially closes on Friday and reopens on Sunday evening. Some experts do not recommend you trade forex on weekends due to frequent gaps for currency pairs. To adjust for the exchange rate loss at the year end the following foreign currency transaction is recorded.

Make sure to look at the article on stop losses and take profits as well. Some traders might not be able to handle early entries that well as they rather wait for a momentum break. Others might find it easier to trade a pullback as they are able to plan the trade more ahead of time.

Kohle Capital Markets (KCM) is Thrilled with the Overwhelming Responses at Traders Fair Bangkok 2023 – Yahoo Finance

Kohle Capital Markets (KCM) is Thrilled with the Overwhelming Responses at Traders Fair Bangkok 2023.

Posted: Wed, 01 Mar 2023 08:02:00 GMT [source]

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts.

Best Forex Trading Platforms for Beginners in the UK

A perfect trade entry strategy will keep us out of random trades. It finds out quality trade in forex, on time, with solid entry signals that behaving the way we would expect in our potential trade area. The entry price represents the price at which traders buy and sell securities.

The journal reflects the revenue from the sale and the amount due from the export customer at current https://day-trading.info/ rates. A similar process applies for a foreign currency transaction when a business undertakes export sales to overseas customers. Suppose the business uses USD as its reporting currency and exports goods to the UK, agreeing a sale value of GBP 5,000. The image above shows how round levels automatically drawn by the Round Level indicator are forming key levels on the weekly USDJPY chart.

How to Enter a Forex Trade

The amount due is currently reflected in its accounting records at USD 6,250, and the difference of USD 150 is a further foreign currency transaction loss. Due to the change in exchange rate between the year end date (1.25) and the settlement date (1.22) the business only needs to pay USD 8,540 to settle the liability of GBP 7,000. The liability is currently reflected in its accounting records at USD 8,750, and the difference of USD 210 is a further foreign currency transaction gain.

Consider all the instances in which their https://forexanalytics.info/ system indicated a good time for a short or a long position. If these are in disagreement, delay forex trading until they are in sync. It means understanding your personality, strengths, weaknesses, and goals. This knowledge will help you make objective forex trading decisions and pick the most appropriate course of action. The value of the accounts receivable asset due from the customer is now calculated as follows. This shows that at the exchange rate of 0.77 USD 1,200 is worth GBP 924.

So, the best day of the week to buy stocks is during the last 30-minutes of the Monday trading session. Historically, stock prices have the tendency to fall during the first trading day of the week and reverse by the next day – on Tuesday. The exit strategy is more important than the entry strategy. We’re going to explain the importance of having an easy trade entry in the markets. If you’re basing your entry strategy on your feelings, that’s not a proper way to approach the market.

https://forexhistory.info/ also referred to as the interbank rate because this is the rate banks use to trade currencies with one another. But that doesn’t necessarily mean this is the rate banks will use when they trade currency with you, the customer. With so many ways to trade currencies, picking common methods can save time, money and effort. By fine tuning common and simple methods a trader can develop a complete trading plan using patterns that regularly occur, and can be easy spotted with a bit of practice. Head and shoulders, candlestick and Ichimokuforex patterns all provide visual clues on when to trade.

Here, patterns such as the engulfing and the shooting star are frequently used by experienced traders. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money. An exit point refers to the price at which you want to close your position and go out of the market or trade.

Position sizing is more important than the entry strategy. In other words, you need to know why you’re entering the trade. For forex trading, you can check Forex Entry Methods – Where and How. You check the heatmap and live currency alert system and you see when the CAD is strengthening on all pairs. The heatmap should have consistent signals like you see below.

Trends, moving averages, candlesticks, Fibonacci retracement, and breakouts help traders make the right decisions every day. Example entry #3 records an unrealized foreign exchange gain of 2,249 USD because the transaction settled after year end would not be a realized gain for tax purposes. The unrealized gain is a reversal of the unrealized loss recorded in example entry #2. Master our free forex trading course and you can understand how to appropriately use forex entry and exit strategy.

In an uptrend a down candle real body will completely engulf the prior up candle real body . Triangles are very common, especially on short-term time frames. Triangles occur when prices converge with the highs and lows narrowing into a tighter and tighter price area. They can be symmetric, ascending or descending, though for trading purposes there is minimal difference.

I am always looking to trade with the trend in my favor and trending markets are the easiest to trade. This is also why we advise new trader to stick to trending markets. In saying that range and counter trend markets, whilst being trickier to trade can also be good markets to trade and traders need to be able to trade and manage trades in all types of markets.

Gains and losses in realized and unrealized form through forex transactions vary whether the entire transaction is finished until the end of the total accounting period. For instance, if you think that the euro will have increased value, you; won’t simply purchase euros. You will need to look out for other currencies against which you consider that euros appreciate well. Thus, you can buy EUR/USD, which can effectively be said as a bet that the euro appreciates well in value against the U.S. dollar. People exchange currency every single day, in real life or business. The key thing I’m trying to share is paying attention to where the market structure is at on the higher time frame.

If you do any sort of business with overseas companies, you’ll likely end up sending or receiving payments in a currency that’s different from your home currency. Ichimoku is a technical indicator that overlays the price data on the chart. While patterns are not as easy to pick out in the actual Ichimoku drawing, when we combine the Ichimoku cloud with price action we see a pattern of common occurrences. The Ichimoku cloud is former support and resistance levels combined to create a dynamic support and resistance area.