Contents:

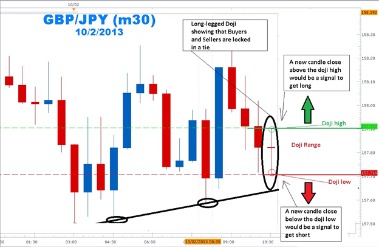

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Now, before we reveal the better way to trade the engulfing pattern trading strategy, it’s important to understand what’s going on behind the scene. Don’t worry if you already know how engulfing trading works, we have some additional information for you as well. This will strengthen your existing knowledge about the engulfing candle trading strategy and help you find new opportunities to succeed as a trader. Notice how the second candle following the engulfing pattern didn’t quite touch the 50% level, although it did come within 15 pips of it. This goes to show that using a 50% entry is not an exact science, nor is any other strategy or technique used in trading the Forex market.

Avert high risk, although the potential profit could be lower. Nordman Algorithms is not liable for any risk that you face using a ready-made indicator from Nordman Algorithms indicators base. All the software pieces are coded in accordance with some common known trading concepts and Nordman Algorithms does not guarantee accuracy or performance of the software entry setups. Trend reversal trading strategy “Engulfing Bar” is designed mainly for Forex and can be used on all currency pairs on any time frames. These additional signals provide traders with greater conviction before executing a trade.

When Does a Bullish Engulfing Pattern Appear?

All 3-D charts are followed by 2-D contour charts for Profit Factor, Sharpe Ratio, CAGR, and Maximum Drawdown. The final two pictures show sensitivity of Equity Curve in $ and risk multiples. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Discover the range of markets and learn how they work – with IG Academy’s online course. If you want to take your trading to the highest point of success, you need to be able to maximize your profits with each trading opportunity.

In this way, an engulfing candle can be a bearish or bullish pattern. In fact, a bullish engulfing signal, combined with other patterns at a certain support level, is a warning to market participants that a reversal is imminent. And the resistance level, in this case, is an approximate take-profit target. That is, by determining the support and resistance levels, you can find more profitable entry and exit points while reducing risks. The chart shows a bullish engulfing candlestick circled in red on the daily scale. The first candle is black followed by a white one in which the body of the white candle covers, overlaps, or engulfs the body of the black candle.

Statistically speaking, candlestick patterns have a high failure rate, which is why we come with the idea to fade the engulfing bar pattern. Of course, candlesticks can indeed be useful–but advanced trading strategies will require you to look beyond these basic charts and think deeper. Establishing the potential reward can also be difficult with engulfing patterns, as candlesticks don’t provide aprice target.

How to trade the Bullish Engulfing pattern

It consists of a small green candlestick followed by the big red one. HowToTrade.com helps traders of all levels learn how to trade the financial markets. Engulfing patterns can produce false bearish or bullish reversal signals.

The key thing to look for when identifying this pattern is the change in momentum from bearish to bullish. This is indicated by the large difference in the size of the two candlesticks. It is critical to pay close attention to this pattern and use it to your advantage if you want to succeed. If you notice a pattern known as a bullish engulfing, you can anticipate that buyers will be in control of the market and that the price will continue to rise.

- When the MACD line crosses above the signal line, it is a bullish signal, and when it crosses below the signal line, it is a bearish signal.

- This is especially true if the size of the candle is small or of similar size to the earlier candles.

- Engulfing candles are easy to identify and trade in real-time.

- These include white papers, government data, original reporting, and interviews with industry experts.

Use a 200-period simple moving average indicator to check if the price can go even higher. To spot this probability, you should look if the price reaches the moving average line. If the trend reversal starts at that level, the price is expected to boost significantly. When it comes to trend trading, the engulfing candle is a valuable tool. This candle pattern can provide traders with information about the current trend’s strength and the likelihood of continued momentum. It’s possible that the potential gain from the deal won’t be enough to justify taking the risk.

This CYCLE I tested makes money… I took 100 Trades with the S…

With the trend isolated and a pullback occurring, wait for the engulfing candle strategy trade signal. The piercing pattern is a two-day candle pattern that implies a potential reversal from a downward trend to an upward trend. A white candlestick depicts a period where the security’s price has closed at a higher level than where it had opened. Most traders prefer to trade using technical indicators like RSI and MACD. In this article, we want to tell you about another powerful tool similar to RSI but with some cool tweaks.

The bullish engulfing strategy and Bearish Engulfing Bar are reversal Price Action signals. This means that engulfing bars can be used to catch potential reversals in the market. Engulfing Bars can be played with or against the trend however they must always be traded from swing points. For an engulfing bar to be valid it must fully engulf at least one previous bar or candle. The engulfing bar can engulf more than one bar as long as it completely engulfs the previous bar.

By incorporating this pattern into their strategies, traders can potentially achieve their financial goals. This provides a positive risk-to-reward ratio, maximizing potential profits while minimizing potential losses. The GBP/USD daily chart is a prime example of this strategy in action. By incorporating the bullish engulfing candle pattern into their trading strategies, forex traders can potentially achieve greater success in the markets.

For our test as a https://g-markets.net/ exit rule we have used a Trailing Stop of 30 pips which is launched after a trade has started and is modified each new 1 pip of profit. From our point of view, such approach allows to maximize profit and minimize drawdown. As you can see, the USD/CHF pair was in a downward trend when a smaller red candle was followed by a bigger bullish candle. It’s important to wait for the second candlestick to close before entering a trade.

So after backtesting the bullish engulfing candlestick pattern 100 times, here’s what I found out. It is said that the price on the next day on the daily timeframe, will make an upward move after an engulfing pattern occurs. And during this backtest, 54 out of 100 times, the price did make a move in the upward direction. It made an upward move 8 times in a row, and failed to do the same 5 times in a row. We only need the approximate win rate and money management will do the rest. After testing 100 times, we found that the bullish engulfing candlestick pattern is a profitable candlestick pattern.

What is an engulfing pattern?

The bullish engulfing is a bullish reversal pattern that means the trend will turn up. The bullish engulfing pattern is reliable and allows traders to define the trend pivot points and determine profitable entry points. In trading any asset, it is important first to determine the support and resistance levels to spot a potential pivot point. In addition, it is important to control trading volumes and the location of large limit and market orders by the Depth of the Market. Based on these data, in conjunction with candlestick and indicator analysis, it is possible to determine a more advantageous entry point. A bullish and bearish engulfing patterns usually tells traders that an existing trend will likely start turning around.

In a downtrend, the declining waves are larger than the pullbacks higher, creating overall progress lower. During a downtrend, you should take only short positions, selling a borrowed asset with the intention of buying and returning it later at a lower price. Inside days are candlestick charts that occur within the bounds of a previous days’ highs and lows. After the pattern is confirmed, you need to open a sell order at the next candlestick.