Содержание

The first method used by Forex forecasters is technical analysis. This website includes information about cryptocurrencies, contracts for difference and other financial instruments, and about brokers, exchanges and other entities trading in such instruments. Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. This trading strategy works well as a trend following trading strategy.

There are determined patterns in the FX market, and they are usually comprised of reliable factors. Although these methods differ, each one can help Forex traders to understand how https://forexbitcoin.info/ rates are affecting the trade of a certain currency. Experienced traders and brokers who are well acquainted with each method can use a mixture of the two with great efficiency.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Spot Gold and Silver contracts are not subject to regulation under the U.S. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.

USD/JPY: In the US its GDP vs inflation

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Forex charting software helps traders analyze foreign currency pairs price trends, enabling them to make informed trading decisions. Most forex brokersallow you to open a demo account before funding a standard or mini account. This try-before-you-buy option will enable users to try out each broker’s software during a trial period and determine which software and broker best suit their needs. The goal is to automate identification of technical indicators or chart patterns across a range of currency pairs in order to identify trade entry and exit points. This indicator indicates trend direction by displaying bars on the price chart, which is based on the Exponential Moving Average .

This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. A forex trading bot or robot is an automated software program that helps traders determine whether to buy or sell a currency pair at a given point in time. There are a number of existing AI-based platforms that try to predict the future of all Forex and metal markets.

This indicator is displayed using two lines that oscillate freely from positive to negative and vice versa. The slower moving line is drawn as a dashed line while the faster moving line is drawn as a solid line. Having the faster line crossing above the slower line could indicate a bullish trend direction, while having the faster line falling below the slower line could indicate a bearish trend. The solid line changes color based on the direction of the trend. A green line indicates a bullish trend while a red line indicates a bearish trend. With the data gained from our website and your own fundamental research you can start building a portfolio.

WHAT IS THE FOREX FORECAST POLL?

Traders make money by picking the right direction at the right time. Those who have mastered the art of getting these two things right stand to make a lot of money in the forex market. However, getting these two things right might be harder than it looks. Gold finally broke out of the consolidation after being range bound for nearly 11 days. The correction to the downside was expected as gold traded in the overbought territory…

The entire responsibility for the contents rests with the commentators. Reprint of the materials is available only with the permission of the editorial staff. There are multiple providers of forex signals send traders positions that are ready to be traded out of box. FXStreet has its own signals service with experts at different markets.

A sentiment indicator which delivers actionable price levels, not merely “mood” or “positioning” indications. Traders can check if there is unanimity among the surveyed experts – if there is excessive speculator sentiment driving a market – or if there are divergences among them. When sentiment is not at extremes, traders get actionable price targets to trade upon. When there is deviation between actual market rate and value reflected in forecasted rate, there is usually an opportunity to enter the market. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Prior to making transactions one should get acquainted with the risks to which they relate. Forex Ratings shall not be liable for any loss, including unlimited loss of funds, which may arise directly or indirectly from the usage of this information. The editorial staff of the website does not bear any responsibility whatsoever for the content of the comments or reviews made by the site users about the forex companies.

Top Broker

Hawkish policy outlooks from Bullard and Mester , on top of more strong economic reports, added to the selling pressures in Treasuries and on Stocks… Spot gold remains above the 100 and 200-day MAs despite yesterday’s selloff. The best strategy for one person could be the worst one for others. There are several questions that need to be answered ahead of defining it. «Support and Resistance Lines conform the most basic analytical tools and are commonly used as visual markers to trace levels where the price…»

Despite today’s early strength, gains are being limited by hawkish comments from Federal Reserve Chair Jerome Powell’s message that interest rates would have to go higher and possibly faster. Fibonacci extension of the 2021 advance, the 2022 swing high and the 2020 March reversal close. A breach / weekly close above this threshold would be needed to mark resumption of the broader 2021 advance. Different suppliers of this technology will offer various features and software functionality. Some versions of the software are available online for free, and many brokerages provide a version of this software for their clients. Skylar Clarine is a fact-checker and expert in personal finance with a range of experience including veterinary technology and film studies.

– How to Start Trading in 4 Easy Steps

By Skerdian Meta, Lead AnalystThe Euro has been on a bearish trend against the US Dollar since 2008, and many analysts have predicted parity for the EUR/USD… For a look at all of today’s economic events, check out oureconomic calendar. Investors will closely watch the Fed’s updated “dot plot” of rate expectations at March’s meeting for further indications of how high Fed officials expect to raise rates.

AUD/USD Forecast: Aussie Breaks Through Support – DailyForex.com

AUD/USD Forecast: Aussie Breaks Through Support.

Posted: Wed, 08 Mar 2023 10:11:36 GMT [source]

Trend direction will be based on how the solid and dashed lines overlap, as well as the color of the solid lines. We should also observe where the solid and dashed lines are on the oscillator. It should show signs that it is about to cross from negative to positive or vice versa, indicating that price is about to reverse. The good thing is there are ways to narrow down your entry window depending on your trading strategy. There are also strategies that could pinpoint the exact entry candle for you.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. This approach looks at the power of economic growth within various countries, in order to make a currency market forecast concerning the direction of exchange rates. The logic behind this approach is that a powerful economic environment and high growth has a bigger likelihood of attracting foreign investors.

There are a number of methods available to a trader when forecasting the Forex market. Each system is used to gain an understanding of how Forex works, and how various fluctuations how to become a successful forex trader in the market can affect traders, and consequently currency rates. Technical analysis and fundamental analysis are the most commonly used methods used by professional traders.

- A forex chart graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs.

- This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

- Trend direction will be based on how the solid and dashed lines overlap, as well as the color of the solid lines.

- The US Dollar may rise if another solid non-farm payrolls report underscores a tight labor market amid sticky price pressures, causing the Federal Reserve to remain tighter for longer.

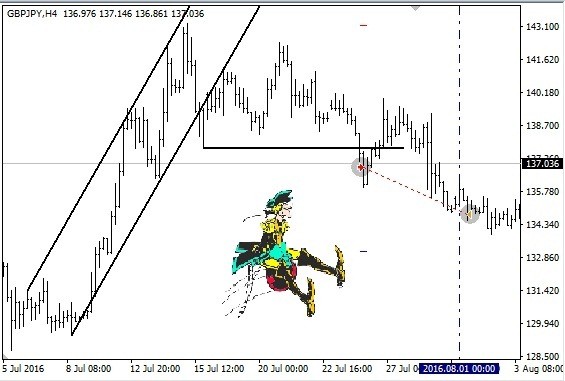

- The Forex Forecaster indicator would serve as the initial trend reversal indication.

- Fed funds futures now imply a nearly 70% chance the Fed will raise rates by 50 basis points this month, up from just about 9% a month ago.

Traders should move stop losses to breakeven whenever possible and trail stop losses in order to protect profits. Aside from the bars, this indicator also provides trade entry signals by placing arrows on the price chart whenever it detects a trend change. Blue arrows pointing up indicate a bullish trend, while red arrows pointing down indicate a bearish trend. The arrows appear on the second bar that displays the same color. In a way, this indicator provides trade signals on a confirmed trend reversal by waiting for the second bar to confirm the trend change.

Bitcoin price falls to a multi-month low, but data points to a possible short-term bounce

«Advisory Opinion, comprised of arguments and trade ideas which have been committed to publication and therefore have an influence on the trading public, are considered a sentiment indicator.» For a comprehensive overview of where key markets might be headed next, and to take advantage, download one of our quarterly forecasts for major FX pairs, commodities and equities. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. We also indicate the average price forecast as well as the average bias. The #FXpoll is not to be taken as signal or as final target, but as an exchange rates heat map of where sentiment and expectations are going. The Forex Forecast Poll is a sentiment tool that highlights near- and medium-term price expectations from leading market experts.

We aims to be a place where every forex traders can gain resources about trading. Forex forecasting software is an analytical toolkit used to help currency traders with foreign exchange trading analysis through technical charts and indicators. Forex forecasting software, while not guaranteed to be entirely accurate, makes it easier to apply technical analysis and make short-term predictions about the market’s direction. This information is helpful to individual traders looking to minimize losses and maximize profits.