Contents:

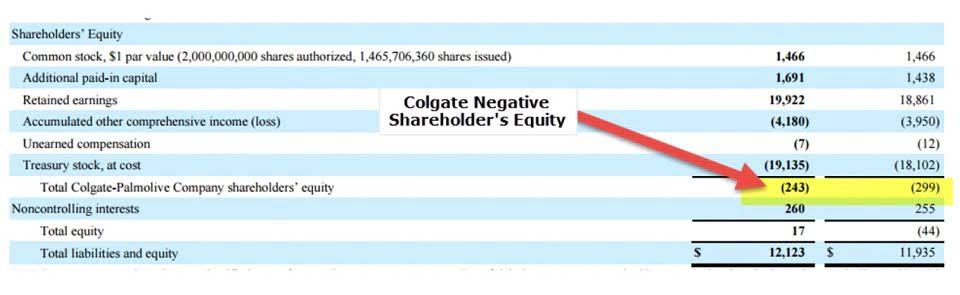

That does not mean that all companies with large growth rates will have a favorable Growth Score. But, typically, an aggressive growth trader will be interested in the higher growth rates. Debt to Equity (or D/E ratio) is total liabilities divided by total shareholder equity. With no resistance above and support from accumulated volume @ $36.56, some $3.63 (9.03%) from the current price of $40.19, our system finds the risk reward attractive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Provide specific products and services to you, such as portfolio management or data aggregation. Forward P/E gives some indication of how cheap or expensive a stock is compared with consensus earnings estimates. For US and Canadian Stocks, the Overview page includes key statistics on the stock’s fundamentals, with a link to see more. Provides a general description of the business conducted by this company.

Additionally, trading for the stock in the period of the last six months notably improved by 39.22%, alongside a boost of 7.20% for the period of the last 12 months. The shares increased approximately by 4.78% in the 7-day charts and went down by 11.40% in the period of the last 30 days. Common stock shares were driven by 40.36% during last recorded quarter.

Has Amphastar Pharmaceuticals (AMPH) Outpaced Other Medical Stocks This Year?

A ratio of 2 means its assets are twice that of its liabilities. A ‘good’ number would usually fall within the range of 1.5 to 3. Like most ratios, this number will vary from industry to industry. Cash flow itself is an important item on the income statement. While the one year change shows the current conditions, the longer look-back period shows how this metric has changed over time and helps put the current reading into proper perspective. Also, by looking at the rate of this item, rather than the actual dollar value, it makes for easier comparisons across the industry and peers.

The consensus among Wall Street research analysts is that investors should «buy» AMPH shares. Now, considering the stocks previous presentation, multiple moving trends are noted. Year-to-date Price performance of the company’s stock appears to be pessimistic, given the fact the metric is recording 40.86%.

NewsAmphastar Pharmaceuticals Inc.AMPH

Webull Financial LLC is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). An explanatory brochure is available upon request or at Our clearing firm, Apex Clearing Corp., has purchased an additional insurance policy.. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. As of March 13, 2023, Amphastar Pharmaceuticals Inc has a weighted four-quarter relative price strength of 9.13%, which translates to a Momentum Score of 86 and is considered to be Very Strong. Amphastar Pharmaceuticals Inc is up 4.17% from its previous closing price of $35.71.

Value investors frequently look for companies that have low price/book ratios. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks.

Stocks Showing Rising Market Leadership: BioXcel Therapeutics … – Investor’s Business Daily

Stocks Showing Rising Market Leadership: BioXcel Therapeutics ….

Posted: Tue, 04 Apr 2023 07:00:00 GMT [source]

According to Grand View Research, the global AI boom could grow from about $137 billion in 2022 to more than $1.81 trillion by 2030. And investors like you always want to get in on the hottest stocks of tomorrow. For the readers interested in the stock health of Amphastar Pharmaceuticals Inc. . When the transactions were called off in the previous session, Stock hit the highs of $39.64, after setting-off with the price of $39.04.

The https://1investing.in/ with the worst average Zacks Rank would place in the bottom 1%. The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank. All values as of most recently reported quarter unless otherwise noted. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. Amphastar doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report.

Stock Activity

The 50-day moving average is a frequently used data point by active investors and traders to understand the trend of a stock. It’s calculated by averaging the closing stock price over the previous 50 trading days. Amphastar Pharmaceuticals Inc 50-day moving average is $34.69.

- Consensus Price Target is the stock price analysts expect to see within a period of 0-18 months.

- All investments involve risk, and not all risks are suitable for every investor.

- Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

- This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Style is calculated by combining value and growth scores, which are first individually calculated.

top 5 factors that affect gold rate in indialy, there are 48.30 million shares of Amphastar Pharmaceuticals Inc stock available for purchase. Forecst.com predicts future values using technical analysis of a large number of analytical parameters. AMPH stock returns are also predicted based on historical data. Key Insights Significantly high institutional ownership implies Amphastar Pharmaceuticals’ stock price is sensitive to…

Relative price strength addresses the relationship between a stock price’s trend and the price trend of the market. This ratio is expressed as a percentage and helps investors understand a company’s momentum as well as its value. You can use relative price strength to select investments that have been outperforming the market or a specific benchmark. Amphastar Pharmaceuticals Inc’s price-earnings (P/E) ratio is currently at 20.4, which is low compared to the Pharmaceuticals industry median of 20.4. The price-earnings ratio gauges market expectation of future performance by relating a stock’s current share price to its earnings per share. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

Our clearing firm Apex Clearing Corp has purchased an additional insurance policy. The coverage limits provide protection for securities and cash up to an aggregate of $150 million, subject to maximum limits of $37.5 million for any one customer’s securities and $900,000 for any one customer’s cash. Similar to SIPC protection, this additional insurance does not protect against a loss in the market value of securities. Securities trading is offered to self-directed customers by Webull Financial LLC, a broker dealer registered with the Securities and Exchange Commission .

Analyst Ratings

Aggregated Micro Power’s stock was trading at GBX 92 at the beginning of the year. Since then, AMPH stock has increased by 0.0% and is now trading at GBX 92. Sign-up to receive the latest news and ratings for Aggregated Micro Power and its competitors with MarketBeat’s FREE daily newsletter. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Back in August, I made the argument why now’s the right time to buy safe stocks. On the downside, the stock finds support just below today’s level from accumulated volume at $36.56 and $36.29.

The 1 Week Price Change displays the percentage price change over the last 5 trading days using the most recently completed close to the close from 5 days before. A ratio of 1 means a company’s assets are equal to its liabilities. Less than 1 means its liabilities exceed its short-term assets (cash, inventory, receivables, etc.).

These 3 stocks are set up for big breakouts

Market Cap is calculated by multiplying the number of shares outstanding by the stock’s price. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price. Amphastar Pharmaceuticals, Inc. is a bio-pharmaceutical company.

Below are the latest news stories about AMPHASTAR PHARMACEUTICALS INC that investors may wish to consider to help them evaluate AMPH as an investment opportunity. The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.AMPH has a Quality Grade of C, ranking ahead of 66.19% of graded US stocks. This means that this stock is suited as a new addition to your portfolio as trading bullish markets is always a lot easier.

Measures how much net income or profit is generated as a percentage of revenue. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. Get your free copy of our special report analyzing the tech stocks most likely to outperform the market. During the last market session, Amphastar Pharmaceuticals Inc’s stock traded between $35.41 and $36.48.

Based on an average trading volume of 256,300 shares, the short-interest ratio is presently 5.7 days. A number of other large investors also recently bought and sold shares of AMPH. Amalgamated Bank boosted its stake in shares of Amphastar Pharmaceuticals by 2.0% during the third quarter. Amalgamated Bank now owns 18,577 shares of the company’s stock valued at $522,000 after purchasing an additional 371 shares during the period. Bank of Montreal Can lifted its holdings in shares of Amphastar Pharmaceuticals by 2.9% in the 1st quarter.