Companies make prepayments for goods or services similar to leased workplace tools or insurance coverage protection that provide continual advantages over time. Goods or services of this nature can’t be expensed instantly as a result of the expense wouldn’t line up with the profit incurred over time from utilizing the asset. Compare the monetary influence of various pay as you go choices in your money move and total prices. Consider components similar to upfront fee quantities, potential reductions or incentives, and the impression on your budgeting and forecasting processes.

Accelerate dispute decision with automated workflows and keep buyer relationships with operational reporting. Unlock full control and visibility of disputes and supply better perception into how they impression KPIs, similar prepaid expenses to DSO and aged debt provisions. Make probably the most of your team’s time by automating accounts receivables duties and utilizing data to drive priority, motion, and outcomes.

Prepaid bills function by allowing businesses to make advance payments for goods or services, with the intention of using or consuming them over multiple accounting intervals. To perceive how prepaid expenses work, think about a state of affairs where an organization pays for an annual software subscription upfront. Although being a easy idea, it’s important for a company to appropriately account for and acknowledge pay as you go bills on its stability sheet. Prepaid belongings typically fall within the present asset bucket and due to this fact impression key financial ratios.

Prepaid expenses, or Prepaid Assets as they’re generally referred to in general accounting, are recognized on the balance sheet as an asset. A “prepaid asset” is the outcomes of a prepaid expense being recorded on the balance sheet. Prepaid bills result from one celebration paying upfront for a service yet to be performed or an asset but to be delivered.

They can affect liquidity ratios, such as the present ratio, as they symbolize an asset which might be converted into money within the close to time period. Additionally, prepaid bills can influence profitability ratios, as they affect the timing of expense recognition. This ensures that the expense is acknowledged proportionately over time quite than all of sudden. Remember to seek the assistance of along with your accountant or monetary advisor for particular steering on your small business’s unique circumstances. Instead of recognizing the entire expense in a single go, the cost is allotted over the duration of the subscription. Each month, a portion of the prepaid expense is acknowledged as an expense on the company’s monetary statements.

For More Data On Automating Your Lease Accounting, Schedule A Conversation With Certainly One Of Our Cpas

If the whole thing of the pay as you go asset is to be consumed within 12 months, then it’s deemed a current asset. However, it’s not unusual to see contracts spanning multiple years, being paid upfront. In these eventualities the portion of the prepaid obligation which exceeds 12 months is recognized as a long-term or noncurrent asset. Understanding prepaid expenses and their journal entries ensures accurate monetary reporting, offering a clear view of your company’s financial well being. Prepaid expenses are principally future expenses which have been paid prematurely, with widespread examples being insurance coverage or lease. These bills are initially documented as an asset on the firm’s balance sheet, and as its advantages are eventually realised over time, they’d then be categorised as an expense.

BlackLine and our ecosystem of software program and cloud partners work collectively to transform our joint customers’ finance and accounting processes. Together, we provide revolutionary options that assist F&A groups obtain shorter close cycles and better controls, enabling them to drive higher decision-making throughout the corporate. Timely, reliable knowledge is critical for decision-making and reporting throughout the M&A lifecycle. Without correct data, organizations threat making poor business decisions, paying too much, issuing inaccurate financial statements, and different errors. Each month, an adjusting entry will be made to expense $10,000 (1/12 of the prepaid amount) to the revenue assertion through a credit to pay as you go insurance and a debit to insurance coverage expense.

Significance Of Prepaid Expenses

If a enterprise is looking to enhance its deductions to help decrease its taxes in a given 12 months, prepaying for some of its bills may be an effective strategy. To maintain well timed efficiency of day by day actions, banking and financial services organizations are turning to fashionable accounting and finance practices. Prepaid expense is first recorded as an asset and later debited as an expense.

- Guide your small business with agility by standardizing processes, automating routine work, and increasing visibility.

- Prepaid hire is the payment of a lease that has been made for a set timeframe sooner or later.

- Additionally, a corporation reporting underneath US GAAP should observe the matching principle by recognizing expenses in the interval during which they’re incurred.

- By documenting them correctly in your stability sheets, you’re guaranteeing transparency and compliance with accounting standards.

- Goods or providers of this nature can’t be expensed immediately as a end result of the expense wouldn’t line up with the benefit incurred over time from using the asset.

- When a enterprise makes a prepayment for goods or providers, it increases the pay as you go expense asset account on the steadiness sheet, reflecting the longer term financial profit.

LegalZoom supplies entry to impartial attorneys and self-service tools. Use of our services and products is governed by our Terms of Use and Privacy Policy. Get prompt entry to video lessons taught by skilled funding bankers. Learn monetary assertion modeling, DCF, M&A, LBO, Comps and Excel shortcuts. These articles and associated content is the property of The Sage Group plc or its contractors or its licensors (“Sage”). Please don’t copy, reproduce, modify, distribute or disburse without express consent from Sage.

Where Do Pay As You Go Expenses Appear On The Balance Sheet?

A pay as you go expense is an expenditure that is paid for in one accounting period, however for which the underlying asset won’t be entirely consumed until a future interval. With that, do not allow the term “expenses” in “prepaid expenses” to deceive you. Despite its name, prepaid expenses are not recorded as expenses upon their preliminary cost. It is just as the benefit of the bought services or products will get realised over time the value of the asset could be decreased, and thus, the corresponding amount can be expensed to the firm’s revenue and loss statement.

These articles and related content is supplied as a basic steerage for informational purposes only. These articles and related content material just isn’t an alternative selection to the steerage of a lawyer (and particularly for questions related to GDPR), tax, or compliance skilled. When in doubt, please seek the assistance of your lawyer tax, or compliance professional for counsel. Sage makes no representations or warranties of any type, express or implied, concerning the completeness or accuracy of this text and associated content material.

Also, an already used portion of the pay as you go expense will increase the expense amount entry and decreases the entire prepaid asset worth. In the subsequent part, we’ll delve into the strategies of recording pay as you go expenses in steadiness sheets, providing you with useful insights on finest practices and financial transparency. For occasion, if a enterprise pays $12,000 in lease for a 12-month lease on January 1st, the monthly pay as you go lease expense can be $1,000. – Notable examples of prepaid bills can be hire and insurance payments. BlackLine is a high-growth, SaaS enterprise that is transforming and modernizing the way finance and accounting departments function.

How Are Prepaid Expenses Recorded?

A prepaid expense is a financial asset that businesses pay in advance for items or providers they may receive in the future. Prepaid bills are recognized as assets as a end result of they characterize a dedication that holds the potential to ship economic worth to your business within the days to return. Prepaid hire is the cost of a lease that has been made for a set timeframe in the future. This includes the company making a money payment to the renting firm https://www.globalcloudteam.com/, though because the lease expense wouldn’t have been incurred but, the enterprise will want to report the pay as you go hire as an asset. Moving ahead, this prepaid lease shall be utilised in the future to lower the lease expense as it will get incurred. It’s important to document pay as you go bills because a enterprise should correctly document all of its transactions and resources to have accurate financial statements.

A pay as you go expense however is any good or service that you have paid for but haven’t used but. When the expense is utilised at once or systematically, the transaction is debited from the pay as you go expense account and credited to a specific expense account. Prepaid bills affect financial statements by decreasing the reported bills in the period of cost and rising the expenses within the intervals when they’re recognized. By the top of the twelve-month protection interval, the entire insurance coverage benefits are delivered, the total expenditure was expensed, and the corresponding asset on the steadiness sheet declines to zero. The pay as you go expense line merchandise stems from an organization paying in advance for products/services anticipated for use later.

Pay As You Go Insurance

This strategy is extraordinarily environment friendly, however will result in a considerably accelerated recognition of the expense. As an example, the whole function of buying insurance is to buy proactive safety for any unexpected incidences sooner or later, as there is no insurance agency that might sell insurance masking a earlier occasion. Consequently, insurance expenses will have to be prepaid by the enterprise clients. Besides that, another notable instance would be if the company purchases a huge and costly printer that it intends to utilise over time, the printer could then be acknowledged as a pay as you go expense.

Automating your prepaid bills correctly is necessary to be able to simplify financial processes and precisely represent a company’s financial place. When we have the best to obtain companies or belongings over an agreed-upon time period and we prepaid for the best, the prepaid asset just isn’t derecognized all at one time as with other pay as you go bills. Rather, beneath GAAP accounting, it must be progressively and systematically amortized over the term of the agreement. Under the cash basis a corporation would instantly report the total quantity of the acquisition of an excellent or service to the income assertion as quickly because the cash is paid. Instead, the value of the nice or service must be acknowledged over time as the business realizes the profit.

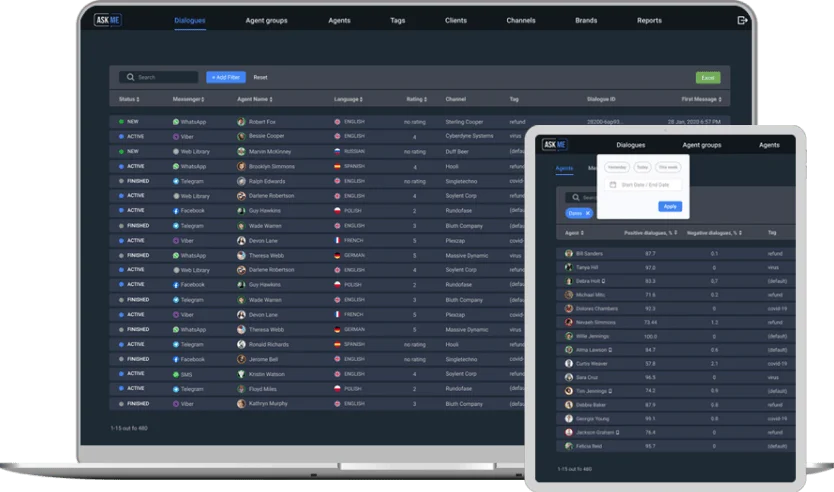

Thankfully though, firms should drastically decrease their danger of encountering minor errors by automating their complete accounting process utilizing sensible credit score management platforms like Kolleno. In abstract, Kolleno is an all-in-one software program that may be integrated right into a business’s current workflow, with the accounting team being seamlessly onboarded very quickly. Thus, the agency need not waste time and human resources to learn a completely novel accounting software for their day-to-day operations.